Big barrels and bold plans as Dorado and Pavo gear up to shake australia’s oil scene and put offshore METS muscle back in motion

, , , , , , , , , , , , , , , , ,

,

, ,

Australia’s offshore oil sector is stirring to life with a new wave of development momentum and exploration ambition, centred on two high-grade liquids discoveries that could materially shift the national fuel balance — and open the door for substantial equipment and service demand across the METS value chain.

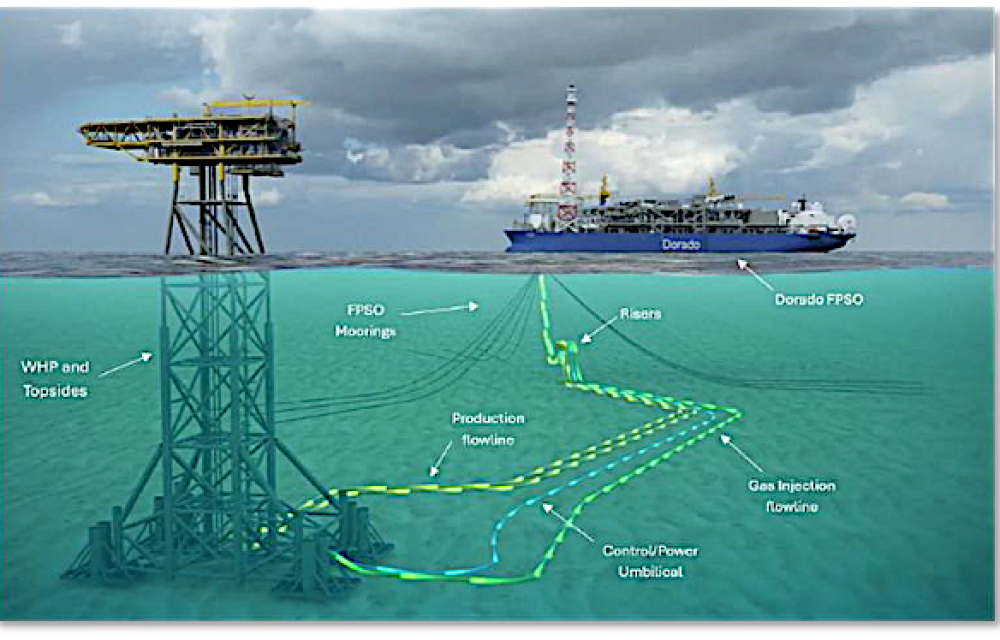

Carnarvon Energy used the RIU Sydney Resources Round-up 2025 to confirm that its Bedout Sub-basin assets — including the Dorado and Pavo fields — are primed for development. These projects are underpinned by around 200 million barrels (gross, 2C) of recoverable oil and condensate and supported by a staged infrastructure approach built around a central wellhead platform tied to an FPSO system.

Speaking at the event, CEO Philip Huizenga outlined how the relatively shallow-water fields (around 90 metres depth) and compact subsurface structures enable a “simple, cost-effective” development scenario. “We’re looking at CAPEX of around US$200 million net to Carnarvon, and operating costs between US$5 and US$10 per barrel,” Huizenga said. “The reservoirs lend themselves to a conventional wellhead platform and subsea tieback to a floating production storage and offloading vessel, or FPSO.”

That development architecture opens opportunities for a wide range of METS providers, particularly in the areas of:

-

Offshore fabrication and modular topsides

-

Subsea production systems and flexible flowlines

-

Control system integration and remote operations tech

-

Drilling services and well completions

-

Marine support and FPSO-related services

The pre-FEED phase is complete, and while the final investment decision (FID) has been delayed, Carnarvon expects to update timelines later in 2025. “We don’t expect these fields to remain undeveloped for too much longer,” Huizenga noted.

Beyond Dorado and Pavo, the company is also preparing to return to the drill bit in 2026. With a 10 to 20 per cent stake in 11,000 square kilometres of prospective acreage in the Bedout Sub-basin, Carnarvon has identified over 130 prospects and leads — including the Ara prospect, which could hold up to 1.4 Tcf of gas and 240 million barrels of liquids in the high case.

“Ara could be a game changer — not only because of what it could deliver itself, but because it could de-risk the broader northern area and unlock further development,” Huizenga said. Exploration success would also drive new demand for well services, seismic acquisition, subsea infrastructure, and reservoir management tech.

The company reported cash reserves of A$186 million at the end of March 2025 and maintains a US$90 million cost carry on future development. A capital management initiative is underway, including a share buyback and a proposed capital return of up to A$125 million.

While the FPSO contractor, topside fabricators, and subsea vendors have yet to be announced, the scale and profile of this offshore play means that METS suppliers should be watching closely.

“This is high-grade crude in a proven basin with clear infrastructure pathways — and we’re eager to get back to drilling,” Huizenga said.