How rare earths are quietly pulling the mining world into a new age of magnetism and redefining the balance of power beneath the surface

, , , , , , ,

, , , , , ,

, , , , , , , , , ,

In mining, every generation gets its own frontier. For ours, it is critical minerals, the suite of metals underpinning decarbonisation, electrification and advanced manufacturing. Rare earth elements may account for only a trace fraction of the periodic table, but they have become central to how the world thinks about energy, technology and sovereignty.

There was a time when global power was measured in barrels. Today, it is measured in magnets.

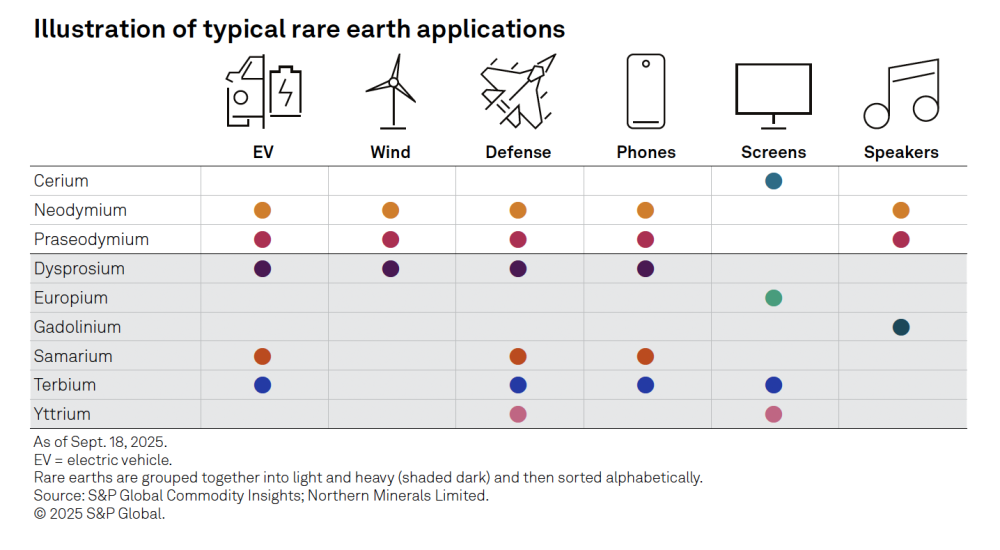

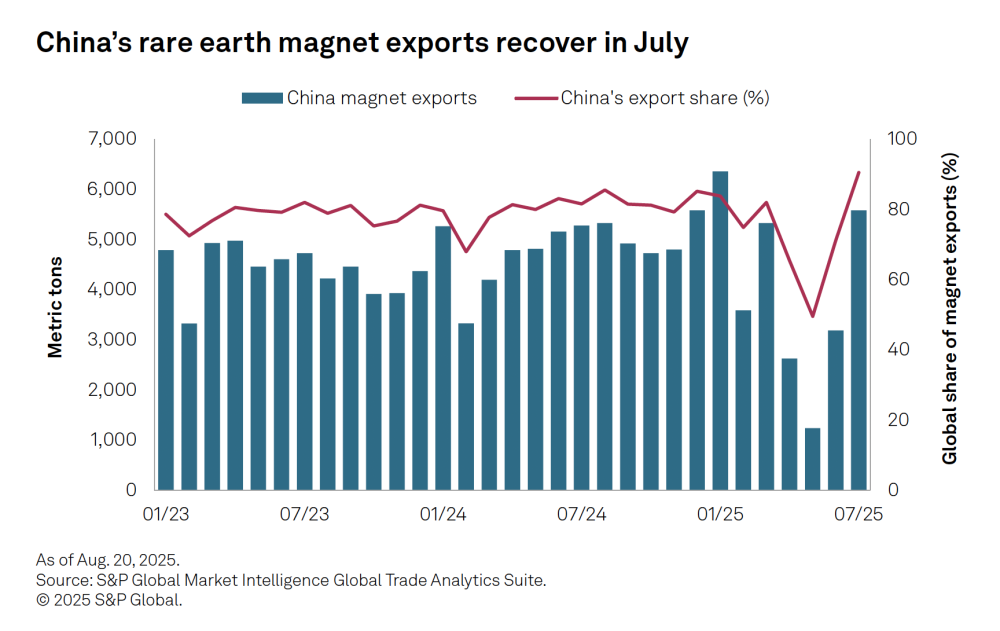

Over the past year, China’s export restrictions on dysprosium, terbium, samarium, scandium and other heavy rare earths have sent a shockwave through supply chains, exposing just how concentrated the downstream value chain has become. These are the elements that make EV traction motors spin, turbines turn and precision-guided systems operate.

Strategic supply becomes strategic leverage

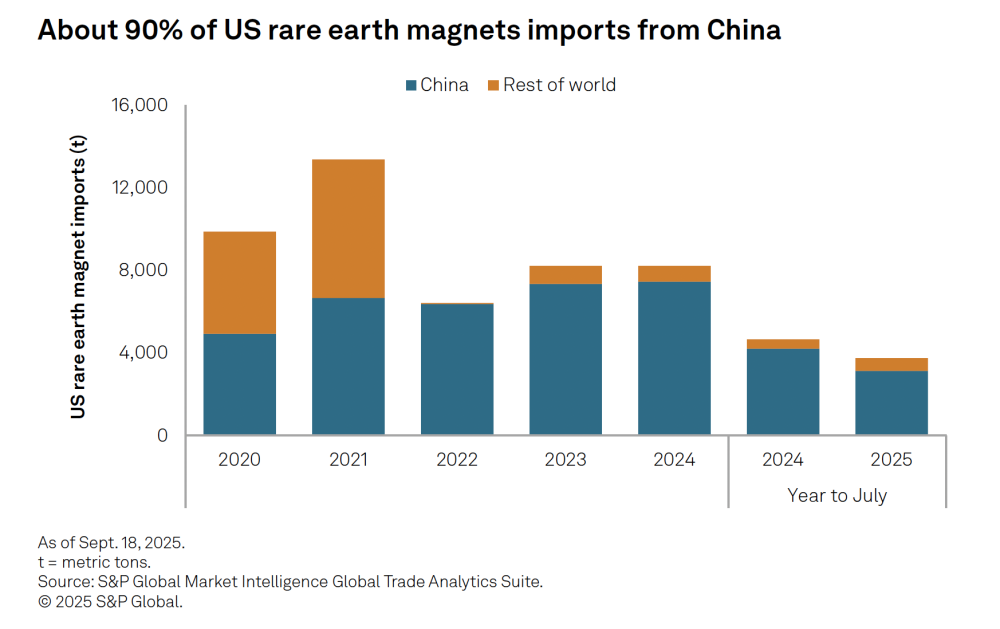

S&P Global’s Rare Earths – A Year of Disruption and Transformation notes that China now supplies around half the world’s mine output and more than 90 percent of its magnet production capacity. When Beijing tightens export licensing, the impact is immediate, from idled EV assembly lines in Chicago to European manufacturers delaying electrification targets.

But beyond the geopolitics lies a more structural shift: the emergence of a mine-to-magnet supply strategy led by governments that once left this domain to market forces.

The United States rewires its value chain

The US Department of Defense has effectively re-entered the industrial policy arena. MP Materials’ Mountain Pass mine is being expanded into a vertically integrated producer with a new magnet manufacturing plant in Texas. The Pentagon’s US$400 million investment and decade-long purchase commitment mark a decisive attempt to rebuild domestic capability.

At the same time, Energy Fuels is repurposing its White Mesa uranium mill in Utah to process heavy rare earths such as dysprosium and terbium, sourced from monazite sands in Madagascar, Brazil and Australia. If the plan succeeds, the facility could become the first large-scale US producer of heavy rare earths by 2027.

Australia’s parallel build-out

While the US races to catch up, Australia is consolidating its position as the most advanced non-Chinese supplier base. Lynas’ Kalgoorlie plant achieved onshore heavy rare earth separation in 2025, Iluka’s Eneabba refinery will follow by 2027, and Arafura’s Nolans Bore project in the Northern Territory is approaching a final investment decision.

Meanwhile, Northern Minerals’ Browns Range, Hastings Technology Metals’ Yangibana and Australian Strategic Materials’ Dubbo project round out a pipeline of integrated rare earth developments. Add in emerging ionic-clay prospects such as Koppamurra in South Australia, and Australia’s critical-minerals ecosystem starts to look more like a full industrial platform than a resource play.

For mining and exploration professionals, this trend translates into tangible workstreams: resource definition drilling, metallurgical testing, beneficiation optimisation and process plant design for high-specification feedstock.

The bottleneck below the surface

China exports only about 30 percent of its processed rare earths; the rest feeds its own EV, wind and electronics sectors. This concentration underscores a hard truth: production alone is not enough. The real constraint lies in separation and metallisation capacity.

Building end-to-end supply chains requires chemistry, capital and consistency of policy. S&P Global describes it as a decade-scale engineering problem, not a short-term commodity cycle. That is why strategic partnerships, long-term offtakes and co-location of refining capacity are now central to project financing.

From rigs to refineries

For drillers, this transformation is more than market noise; it is a pivot in exploration focus. REE-rich carbonatites, ionic clays and monazite sands require precise targeting, selective sampling and specialist analytical workflows. Every refinery begins with an orebody, and every orebody begins with data: core logs, assays and mineralogy that tell metallurgists what is actually recoverable.

This is where the skill set of modern exploration teams, integrating geophysics, geochemistry and machine learning, aligns with the industry’s push toward traceable, low-impact supply chains. In critical minerals, geology and geopolitics now move hand in hand.

A new definition of value

The rare earth sector highlights a broader shift in mining economics. Value no longer ends at concentrate; it extends to the ability to deliver processed material into strategic supply chains. Governments are willing to underwrite this transition with grants, tax incentives and offtake guarantees, but the projects that succeed will be those that can prove technical capability and ESG integrity at every stage.

As one analyst put it, “We are not chasing the next gold rush, we are engineering the next magnet rush.”

The takeaway

Rare earths may be measured in grams per tonne, but their significance is measured in gigawatts, guidance systems and geopolitical weight. The coming decade will test the industry’s ability to align technical excellence with national strategy.

For mining professionals, the direction is clear: critical minerals are no longer a niche, they are the new core business of mining. Keep your instruments calibrated and your assays clean. The magnetic age has begun.