Heap leach upstart taps rare earths and uranium with fast rehab, big grades and a real shot at cracking China’s grip on the magnet metals market

, , , , , , , , , , , , , ,

,

, , , ,

A technically nimble rare earths and uranium junior is pushing toward production-readiness with a scalable extraction strategy and dual commodity focus—designed to suit both the geopolitics of supply chain security and the day-to-day realities of mine site execution.

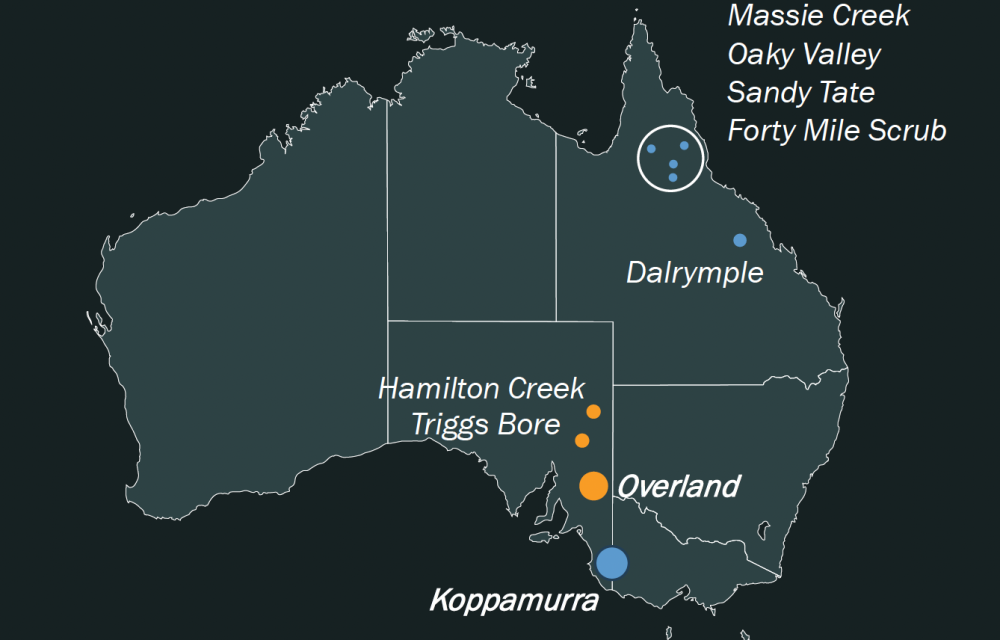

Presenting at the RIU Sydney Resources Round-up 2025, Australian Rare Earths Ltd (ASX: AR3) laid out its updated strategy for the Koppamurra Rare Earths Project and Overland Uranium Project, both in South Australia. With heavy rare earth elements like dysprosium and terbium back in global spotlight, AR3’s Travis Beinke said the market was “sharpening its focus on near-term supply outside of China”.

Rare earths, ready to go

Koppamurra is a large ionic clay-hosted deposit straddling the South Australia–Victoria border. With a defined resource of 236Mt at 748ppm TREO—including a 68Mt high-grade subset over 1,000ppm—the project includes 25 percent magnet rare earths and around 3 percent heavy REEs.

Key to AR3’s strategy is a progressive heap leach model with low water and energy input and rapid, staged rehabilitation. “We’ll target the higher-grade zones first, and our approach lets us scale without pushing up capex,” said Beinke. The company has already demonstrated bulk sample pit rehabilitation, with test sites back to productive pasture within two years.

Beinke confirmed a $5 million co-funding grant from the Australian Government is enabling metallurgical test work, PFS completion, and a mining lease submission in 2025. The plan includes building a demonstration-scale operation in 2026—an agile entry point compared to larger, capital-intensive peers.

AR3’s non-binding offtake MOU with Neo Performance Materials, a Canadian rare earths processor, positions the company inside a real, functioning ex-China downstream chain. “They’ve commissioned a magnet manufacturing plant in Europe—so this isn’t theory. It’s real infrastructure,” Beinke said.

Uranium on deck

While Koppamurra progresses toward development, AR3 is also building momentum in uranium. Its Overland Project covers 4,800km² and lies roughly 200km south of the Honeymoon mine. Initial drilling has returned widespread near-surface calcrete-hosted uranium and confirmed a deeper ISR-amenable sedimentary system.

“What we’ve confirmed is the right recipe—source rocks, permeable hosts, reductants—it’s all there,” Beinke told delegates. The program has identified a north-south palaeovalley with stratigraphy comparable to other ISR-style systems, while the calcrete target shows similarities to Namibia’s Langer Heinrich operation.

2025 work will focus on expanding strike and depth coverage around the western palaeovalley margin, with assays pending from early-stage drilling across multiple zones.

What it means

For practitioners, AR3’s dual-track play is a case study in nimble development:

-

Low capex entry point via heap leach and staged rollout

-

Rehab-proven mining in an agricultural setting

-

Jurisdictional strength, especially in uranium-permitting South Australia

-

Tangible downstream access through Neo

-

Dual mineral systems targeting critical supply chain inputs

With $7.6 million in cash following a shareholder-supported rights issue, the company is cashed-up and technically focused heading into a busy second half of 2025.

As Beinke put it, “This is not about being the biggest—it’s about being fast, strategic, and execution-focused.”