Building blocks and battery dreams: GT1’s low-risk, high-grade strategy to close Ontario’s lithium loop

, , , , , , , , , , , , , , , ,

, ,

In a sector where some juniors are still chasing intercepts and headlines, Green Technology Metals (GT1) is cutting a different path—quietly advancing an integrated, low-footprint lithium supply chain in Canada’s Ontario province with the sort of engineering discipline and metallurgical pragmatism that turns geology into cash flow.

At the 2025 RIU Sydney Resources Round-up, GT1 Managing Director Cameron Henry laid out a staged, technically grounded strategy to deliver spodumene concentrate and battery-grade lithium hydroxide to North American gigafactories from wholly domestic sources. And the company is not just building mines—it’s replicating proven downstream processes via a partnership with Korean chemical producer EcoPro Innovation.

Here’s how GT1 plans to bolt together the pieces.

Tight Flowsheets, Clean Concentrates

The cornerstone of GT1’s Stage 1 development is the Seymour Lithium Project—a near-surface, stacked pegmatite system that has already produced over 64,000 metres of drilling and a 10.3Mt resource at 1.03 percent Li₂O, including a 6.1Mt Indicated component grading 1.25 percent Li₂O.

What sets Seymour apart technically isn’t just the resource—it’s the metallurgy.

GT1 is targeting a Dense Media Separation (DMS)-only flowsheet, supported by variability testwork that has demonstrated:

-

Spodumene concentrates grading up to 6.1 percent Li₂O

-

Iron content under 1 percent Fe₂O₃

-

Recoveries of 61.9 percent from unblended DMS feed

-

Ore sorting compatibility to pre-concentrate run-of-mine ore and lower downstream load

Why no flotation? The ore’s crystal size and chemistry allow for gravity-only processing, which slashes reagent use, reduces tailings complexity, and allows for rapid construction using modular process units. Henry described it as a “simple project… small team to operate, low capex and opex”.

The EcoPro Advantage: Plug-and-Play Processing

While others are still designing pilot plants, GT1 has shipped a one-tonne spodumene concentrate sample from Seymour to EcoPro Innovation’s fully operational Pohang facility in South Korea. The goal: confirm the ore’s suitability for EcoPro’s sulfation route, producing lithium hydroxide monohydrate (LHM) through a replicated 13ktpa hydrometallurgical train.

Key technical benefits of this partnership include:

-

Use of EcoPro’s proven LHM train design, minimising startup issues

-

Standardised process modules for faster approvals and commissioning

-

Access to a tier-one pyrometallurgical OEM, reducing thermal process risk

-

Engineering input from a partner with downstream cathode and battery relationships

“We’re not trying to reinvent the wheel,” said Henry. “We’ll be using a lot of their IP and replicating that to reduce risk”.

GT1’s planned site at Thunder Bay—secured via an LOI—has heavy-lift logistics built in, with existing rail spurs, gas, municipal water, and access to a Great Lakes port, allowing spodumene to move globally if needed.

Map showing Green Technology Metals' 3-stage integrated strategy in Ontario, linking the Seymour and Root lithium projects to a centrally located Thunder Bay conversion facility via a regional processing network optimised for low transport distances and scalable feed. Source: GT1 Investor Presentation - PDAC 2025.

Deep Pegmatites, Deeper Planning: Root Project Upside

GT1’s Root Lithium Project, the long-game Western Hub asset, is no less technically intriguing. The company recently completed 9,132 metres of deep extension drilling that confirmed 20 stacked pegmatites, including intercepts over 700 metres vertically and 1,200 metres down-dip continuity.

A new PEA considers three scenarios combining open-pit and underground mining. Notably, the underground route may be “more economic”, said Henry, due to typical Ontario conditions: hard rock with predictable structures, high groundwater flows, and minimal weathering. GT1 has already begun early contractor engagement and pricing for development.

Root’s current 14.6Mt resource at 1.21 percent Li₂O is likely to grow, with an exploration target of 25–35Mt. The site also benefits from on-tenement hydroelectric infrastructure—namely a 230kV transmission line, among the lowest-cost electricity sources globally.

A Modular, Multi-Stage Execution Model

What’s compelling for METS watchers is the modular build logic behind GT1’s plan:

-

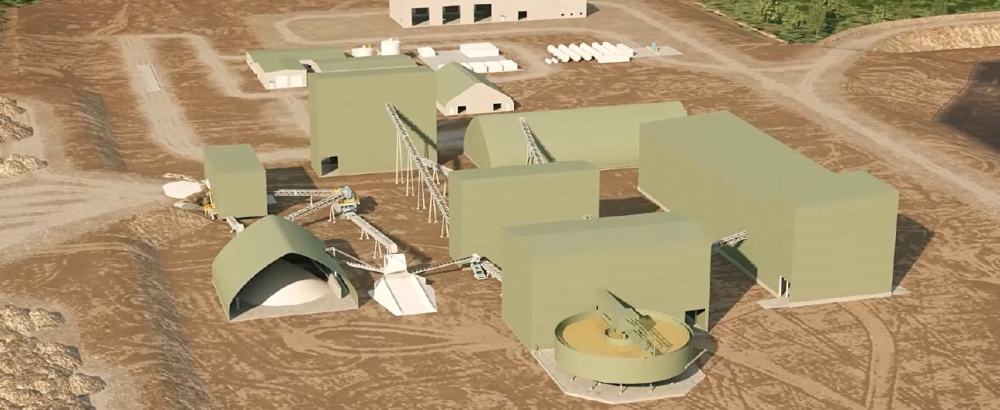

Stage 1: Seymour + DMS concentrator (underpinned by DFS, nearing permitting finish line)

-

Stage 2: EcoPro-integrated LHM conversion facility at Thunder Bay (PFS underway; pilot plant testing active)

-

Stage 3: Root expansion as a second feed source, with design flexibility between pit and underground, and engineered for scale

GT1 is not building the next Greenbushes. Instead, it’s leveraging small-scale infrastructure to derisk capex, tighten commissioning timelines, and match production to regional demand.

That means fewer moving parts, lower startup thresholds, and faster cashflow—a rare find in lithium.

Source: GT1 Investor Presentation - PDAC 2025.

Wrangling Risk in the Battery Supply Chain

Financing, always the final hurdle, is tracking ahead of schedule. GT1 has secured:

-

A C$100M letter of support from Export Development Canada

-

Support from Korea’s KEXIM Bank and other government-backed facilities

-

25 percent offtake agreement for Seymour’s production with LG Energy Solutions

Unlike peers chasing inflated equity or risky pre-pay deals, GT1 is leveraging bilateral government partnerships, critical minerals policy momentum, and private capital matched to staged deliverables.

Conclusion: Built to Work, Not to Wow

GT1’s proposition isn’t flashy. It’s not the biggest resource, or the boldest capex. But for those on the tools, it reads like a feasibility engineer’s dream: good rock, close to rail, processed with proven kit, and supported by real offtake and funding.

As Henry put it to the RIU crowd: “Our strategy has always been to get a low hurdle into production and expand from there.”

In a market littered with hype, GT1’s steady hand and smart tech bets make it a name worth watching—and, for some, working with.