Storm builds in Nunavut as Dave O’Neill reveals low-cost copper play with high-grade punch and gravity-fed ESG creds at RIU Sydney

, , , , , , , , , , , , , , , , , , , , , ,

, , ,

, , , , ,

In a pitch that blended geology with geopolitics, American West Metals managing director Dave O’Neill delivered a standout presentation at the RIU Sydney Resources Round-up 2025, offering investors a compelling vision of what could become the world’s lowest-cost copper mine. The focus? The Storm Copper Project in Nunavut, Canada — a sediment-hosted deposit with scale, simplicity, and surprising logistics advantages.

High Grade, Low Cost, and Zero Tailings

At the heart of American West’s strategy is a belief in lean, clean, scalable copper production. Dave put it plainly: “This will be the lowest cost copper mine on the ASX and potentially on the planet”. Backed by a recently released preliminary economic assessment (PEA), the Storm Project is targeting an initial 10-year open-pit operation producing 100,000 tonnes of copper per year — a scale enabled by coarse mineralisation and amenable geology.

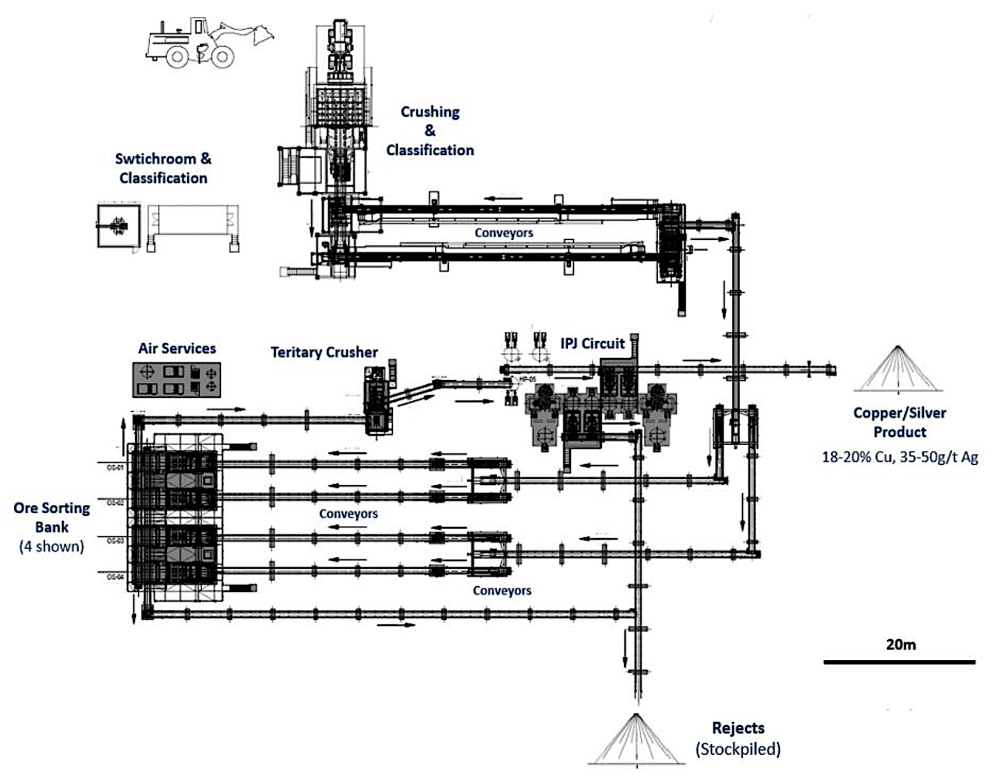

What sets Storm apart is its unorthodox processing route. The mine plan uses a simple crush, sort and jig circuit that eliminates the need for tailings dams and chemicals. O’Neill noted, “It’s gravity separation — the oldest mining technique — no tailings, no chemicals. That’s the upside.”

The result? A product upgraded to 15–20 percent copper, ready to ship, with an initial CAPEX under US$50 million and a post-tax NPV of US$149 million at a copper price of US$4.60/lb.

upgrade of Storm copper-silver mineralisation.

Logistics and Location: Arctic Advantage

Despite its northern latitude, Storm is far from isolated. Just 25 km from tidewater at Aston Bay, the site sits in an active mining district surrounded by giants like Agnico Eagle and MMG. The area boasts year-round mining, a seasonal shipping window (like Teck’s Red Dog zinc mine), and strong local support.

O’Neill dismissed concerns about remoteness: “This is not the middle of nowhere. We’re amongst 10 other mines in the area... It’s a fly-in, fly-out operation, very similar to WA.”

Strategic Backing from Ocean Partners

In a vote of confidence, global metals trader Ocean Partners has taken a 9.5 percent equity stake and will provide US$40 million in project funding. They’ve also locked in 100 percent offtake on the copper concentrate. “We’ve got someone to help us build it, someone to buy it, and someone who believes in the project,” said O’Neill.

Ocean Partners' involvement extends beyond finance — they bring blending facilities, DSO operations, and global trading capabilities. Their backing de-risks development and opens the door to further optimisation of the flowsheet.

Big Belt, Bigger Ambitions

While the PEA outlines an initial mine life of 10 years, O’Neill was quick to point out that this is just the beginning. “Storm is about 5 percent of the land package. We own 100 percent of this 2,000 square kilometre belt — this is a very long-term copper story that’s only going to get bigger.”

Drilling has already identified copper over a 20 km trend, with discoveries like Cyclone Deeps showing grades of 22 m at 8.5 percent Cu — yet to be included in the mine plan. Meanwhile, unexplored prospects like Tornado and Typhoon suggest the potential for a district-scale system akin to the Central African Copperbelt.

ESG and Permitting Tailwinds

Operating in Nunavut, the company has found what O’Neill calls “one of the most straightforward permitting jurisdictions I’ve ever worked in.” Backed by local employment and community engagement, the project was even name-checked in a recent ministerial address — a rare endorsement that underscores its profile.

Importantly, American West has already completed two years of environmental studies and is preparing to package the data for a pre-feasibility study. With no tailings facility, low-impact processing, and tight operational scope, the project sits neatly within modern ESG frameworks.

Beyond Storm: Utah Portfolio Adds Optionality

While Storm dominates the spotlight, American West’s portfolio includes two US-based assets: West Desert, a polymetallic project with one of the world’s largest undeveloped indium resources, and Copper Warrior, adjacent to Utah’s second-largest copper mine. Both projects offer exploration-driven upside and strategic metals exposure.

Final Word

O’Neill concluded with a bullish call to action: “If people want a good copper story, and purely for the growth — we’re doing both. Get on board.” With a sub-$50 million capital outlay, locked-in offtake, and rapid pathway to production, American West is shaping up as one of the more grounded yet growth-oriented copper juniors on the ASX.

For mining investors craving high-grade results with ESG credentials and expansion upside, Storm may just live up to its name.