Sunday Creek drills deep into Victoria’s gold roots with hits so good even antimony wants a share

, , , , , , , ,

, ,

, , , ,

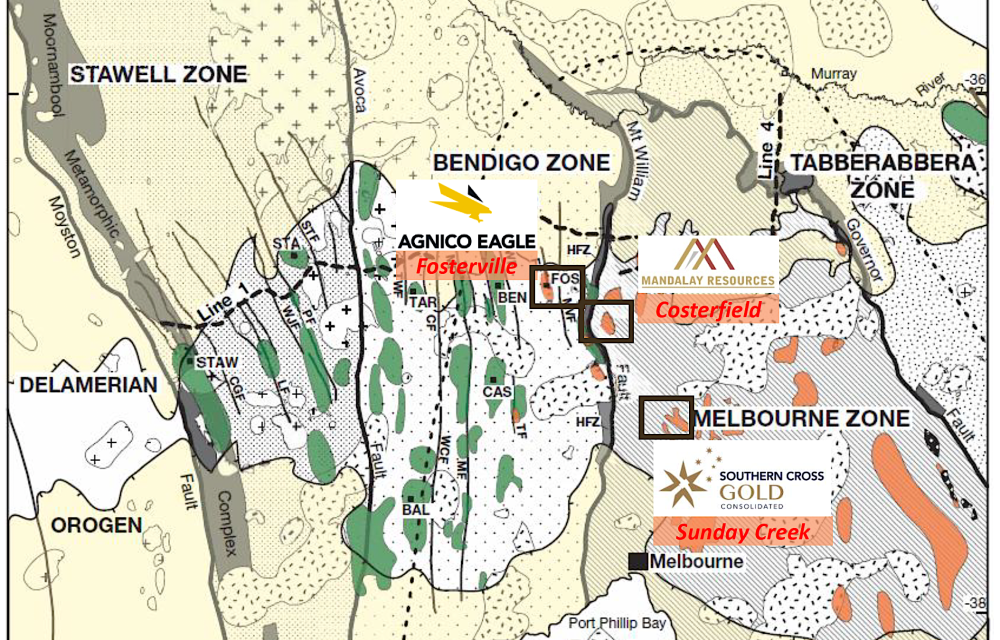

Southern Cross Gold is rapidly redefining the prospectivity of Victoria’s goldfields, with its flagship Sunday Creek project now recognised as one of the highest-grade, undeveloped gold-antimony deposits globally.

Presenting at the RIU Sydney Resources Round-up in early May, company president and CEO Michael Hudson didn’t mince words: “You just don't find those multi-million-ounce, 100% owned deposits. They're very rare … This is one of the few left”.

A rare and growing asset

Sunday Creek, located 60 kilometres north of Melbourne, is a dual-listed asset (ASX: SX2, TSX.V: SXGC) and the standout in Southern Cross Gold’s portfolio. The project hosts an exploration target of between 2.2 and 3.2 million ounces at a gold equivalent grade ranging from 8.6 to 10.5 g/t—numbers rarely seen in modern orogenic gold systems.

Notably, 80 percent of the project's value is driven by gold, with antimony contributing the remaining 20 percent—a mix Hudson says "will help permit it" given antimony’s designation as a critical mineral.

“Antimony is a strategic wildcard,” he said, citing its role in defence supply chains and its potential to attract government support in both Australia and North America.

From alluvial beginnings to high-grade discoveries: Sunday Creek’s mining legacy dates back to the 1850s, with the Golden Dyke Mine pictured here in 1890.

Drilling blitz backed by serious funding

With over A$176 million in the bank following a recent private placement led by top-tier investors—including UHNW names like Darren Morcombe and Pierre Lassonde—Southern Cross is well capitalised to ramp up exploration and development.

Currently operating eight drill rigs, the company is targeting Q1 2027 for a maiden economic assessment and intends to spend A$60 million on drilling alone through that period. Permitting for a decline is underway, with approvals expected before year’s end.

“We're funded for the next three years. But if we bring in 20-plus rigs, that timeline could compress dramatically,” Hudson added.

Not just a drill story

With 63 intercepts greater than 100 gold-equivalent gram metres from 77 kilometres of drilling, Sunday Creek boasts one of the world’s best hit rates. This is underpinned by over 70 mechanically mineable vein structures—most averaging widths between 2.5 and 4 metres—distributed across three main zones: Apollo, Rising Sun, and Golden Dyke.

Drilling has only tested around 5 percent of the mineralised trend to date, suggesting considerable upside. “Even if you drill one of these deposits out, you never forget the exploration upside,” Hudson stressed.

The system is interpreted as a classic epizonal orogenic gold setting—similar to nearby Fosterville—with gold grades improving at depth. “These systems get better the deeper you go, and we’re seeing exactly that at Sunday Creek,” said Hudson.

Victoria: an unlikely permitting powerhouse?

Challenging perceptions, Hudson argued that Victoria may now be the best jurisdiction in Australia to permit a mine, citing recent policy changes that cap environmental assessments to 18 months and an improving track record of approvals.

“Where else in Australia has permitted two mines in the last three or four months?” he asked the audience. “It really, really has changed”.

This permitting momentum coincides with Sunday Creek’s strategic location on freehold land, kilometres away from residential areas—key for both community engagement and development readiness.

Metallurgy, community, and ESG

Preliminary metallurgy results point to a simple gravity-flotation flow sheet with recoveries of up to 97.6 percent for gold and 95 percent for antimony. This supports the project’s development pathway and economic potential.

Southern Cross has also invested in ESG credentials, maintaining local staffing, forming a Community Reference Group, and working with the Taungurung Lands and Waters Council.

Final thoughts

“We’re not for sale. Our investors want us to build this,” said Hudson. “And with a project like this—high-grade, scalable, 100% owned, no royalties—we’re in a strong position to do just that”.