Clinton Booth fires up graphite game as next-gen thermal tech edges closer to commercial heatwave across data, defence and mining markets

, , , , , , , , , , , , , ,

, ,

,

In a presentation that cut through the noise at this year’s RIU Sydney Resources Round-up, Clinton Booth, CEO and managing director of Green Critical Minerals, delivered a sharp and confident pitch to investors, suppliers and technology partners: a new class of high-density graphite is poised to disrupt thermal management across global industries—and the time to get involved is now.

Booth’s message was blunt: “This presentation isn’t about promises—it’s about execution.” And over the course of his 13-minute address, he laid out a compelling case for why his company’s proprietary VHD graphite is moving beyond validation into commercial testing—and could be generating revenue within 12 months.

VHD, or very high density graphite, is engineered for a single but critical purpose: solving heat. In data centres, AI processors, electric vehicles, and aerospace systems, overheating is throttling performance. Traditional materials like copper and aluminium are approaching their thermal limits, and Booth says industry knows it. “Customers are telling us their current solutions are limiting performance. VHD graphite solves that”.

What makes the material stand out is the process. VHD graphite is produced using a low-energy, binder-based method that converts fine graphite powder into machinable blocks with superior thermal conductivity and a lightweight profile. “Think of it like baking a cake,” Booth explained. “You have your ingredients and your method—and what comes out is a block you can shape, drill, tap, and machine into a working component. And we own the rights globally”.

Beyond Hype: A Strategy Built on Speed and Control

Booth told the audience that since acquiring the exclusive global rights to VHD graphite in late 2024, the company has advanced rapidly across three strategic fronts:

-

Technology validation – a pilot plant has been commissioned, the first line is producing full-scale graphite blocks, and performance metrics have been independently verified.

-

Customer engagement – sample materials have been sent, technical Q&A sessions held, and at least two customer engagements are underway, including one formal collaboration agreement.

-

Commercialisation – the company is targeting first revenue by H1 2026, with sales discussions tied to prototype testing and application development.

“We’ve validated the product, built the pilot plant, and customers are now validating our data through their own testing,” Booth said. “It’s no longer theoretical. We’re bridging to revenue—not in the distant future, but in the next 12 months”.

Machined, Tested, Ready

One of the most significant milestones, Booth said, was machining the company’s first full-scale graphite heat sink—a crucial proof of concept that confirmed the material’s thermal performance and its suitability for real-world integration.

“The ability to go from powder to block to end-use component, all in-house or in collaboration with customers, gives us a massive edge,” he said.

Initial feedback has been strong. Booth cited collaboration with a sustainability-focused data centre operator and additional sample requests from high-tech customers. The customer engagement process is designed to scale, with potential partners progressing through technical due diligence, sample testing, and ultimately joint prototyping.

“This is when customers start investing their own time, resources and modelling into understanding VHD,” Booth explained. “That’s the gateway to revenue.”

Vertically Integrated—From Mine to Market

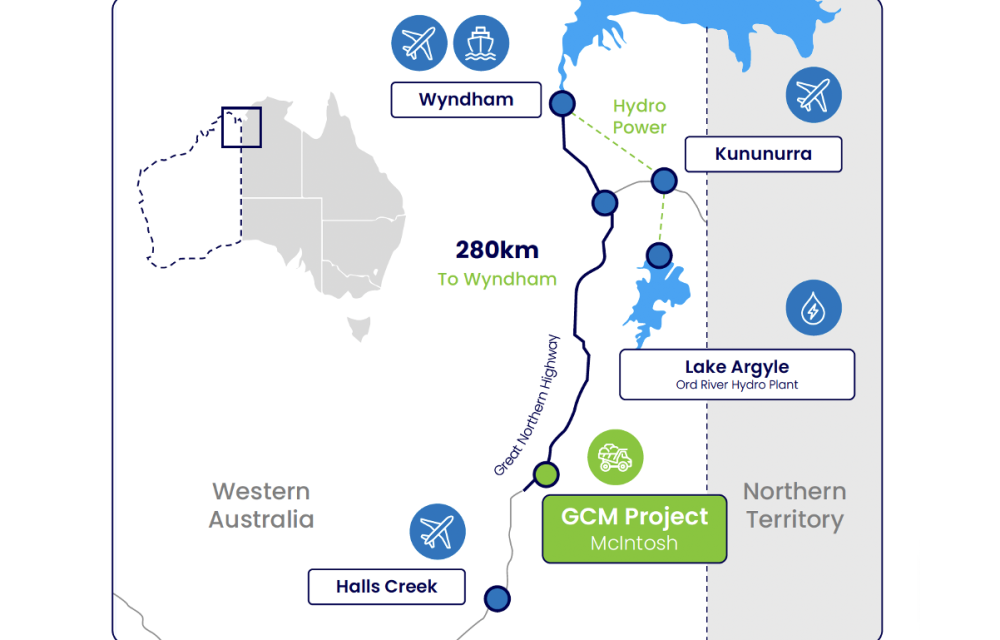

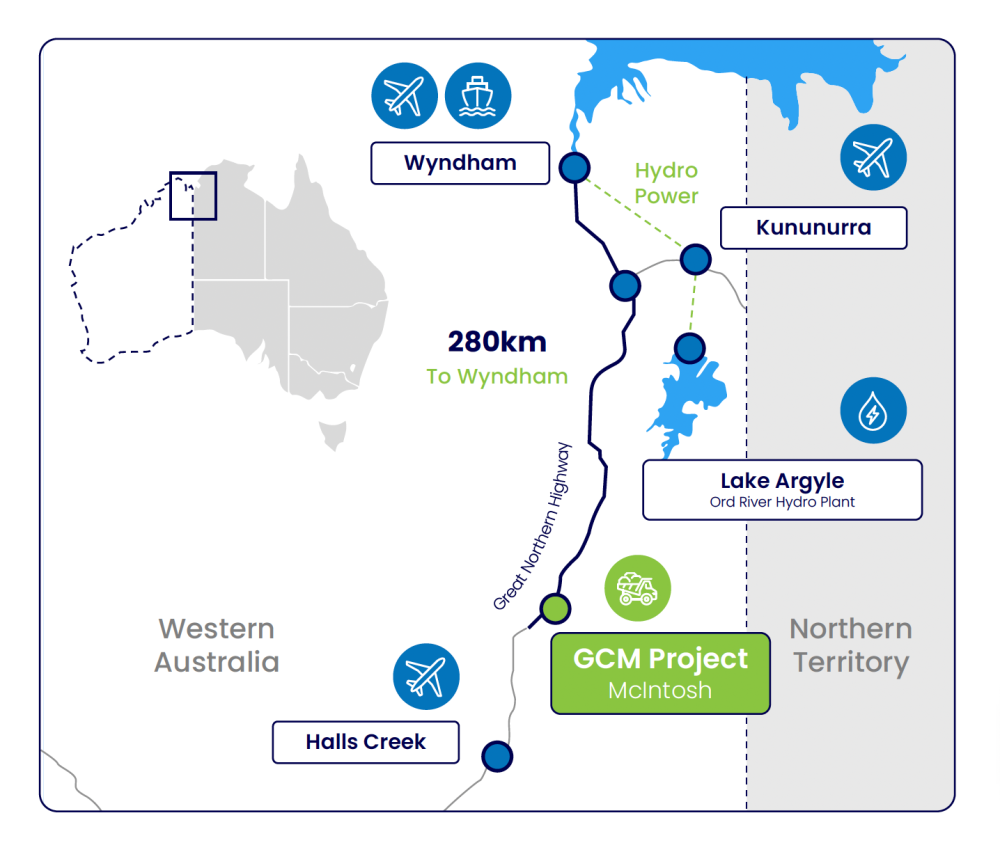

While the RIU Sydney pitch was focused on downstream opportunity, Booth was clear that upstream integration is a major advantage. Feedstock for VHD production will come from the McIntosh Graphite Project in Western Australia’s Kimberley region, where a pre-feasibility study is due this quarter.

Booth said the project will provide high-quality fine flake graphite for use in VHD blocks—offering certainty of supply, quality control, and reduced scope 3 emissions for customers.

“Graphite is abundant, but value lies downstream,” Booth said. “If you want to compete long-term in this industry, you don’t just sell concentrate—you offer ready-to-use thermal products”.

Execution on a Lean Budget

Impressively, GCM’s commercial acceleration has been cost-efficient. Despite building out a pilot plant and expanding customer activities, the company reported a quarterly cash burn of under $600,000.

That’s a standout figure in a capital-intensive sector—and Booth was quick to highlight it. “It shows we’re executing efficiently. We’ve done a huge amount on a lean budget, and that gives us more headroom as we head into scaling”.

Opportunity for METS Players

Booth’s presentation also contained an embedded call-to-arms for METS and advanced manufacturing suppliers. As the company pushes toward scaled production and global customer delivery, it will require:

-

Material processing equipment (graphite compaction, shaping, and forming systems)

-

Thermal testing and QA instrumentation

-

Precision machining and CNC prototyping partners

-

Logistics and warehousing infrastructure (initially in North America and Europe)

-

Engineering support for pilot line scale-up and potential commercial plant development

The VHD process itself uses a relatively low temperature, fast-cycle system, making it suitable for rapid turnaround manufacturing with smaller energy input than traditional graphite synthesis.

Suppliers who can help automate, scale, or co-develop thermal products with the company may find themselves early players in a high-growth materials space.

What’s Next?

Booth said the coming two quarters will focus on:

-

Delivering and testing customer prototypes

-

Signing additional collaboration agreements

-

Finalising commercial discussions with early adopters

-

Expanding the company’s global supply chain capabilities

He also acknowledged that while the company’s current market capitalisation remains modest, it doesn’t reflect the full weight of what’s been achieved. “We see this as a tremendous opportunity for investors, with great upside as we continue our progress to completion of commercialisation and to first revenue”.

Map showing the location of Green Critical Minerals’ McIntosh Project in the Kimberley region of Western Australia, situated 280km by road from Wyndham and near key infrastructure including the Great Northern Highway, Lake Argyle’s Ord River Hydro Plant, and regional airports at Halls Creek and Kununurra.