Gold project digs deeper into value with big ounces, fast payback and bold plans to reshape the map in WA’s high-grade heartland

, , , , , , , , , , , , , , , ,

, ,

,

A pre-feasibility study expected within weeks is poised to confirm the scale, low-cost profile, and near-term development potential of a Western Australian gold project with a consolidated landholding in one of the world’s most productive gold provinces. Positioned near Kalgoorlie, the asset has already returned robust metrics from scoping-level analysis, with project economics expected to significantly improve under updated gold price assumptions and refined mine designs.

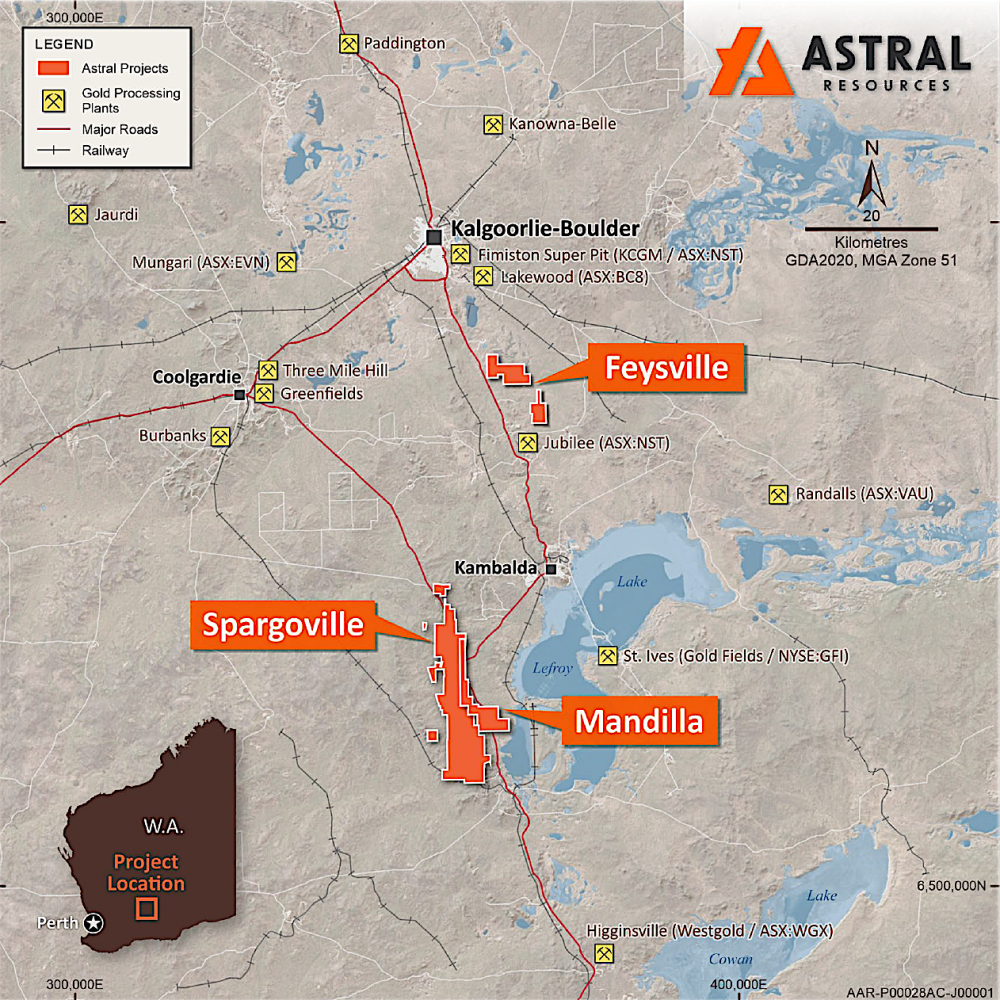

The project is being progressed by Astral Resources NL (ASX: AAR) and centres on the Mandilla Gold Project, located just 70km south of Kalgoorlie-Boulder in WA’s Goldfields. The study follows substantial work over the past 12 months, including strategic tenement consolidation, resource upgrades and technical de-risking activities that have put the company on track for a final investment decision by mid-2026.

According to managing director Marc Ducler, who presented at the RIU Sydney Resources Round-up in early May, the project has “matured” considerably over the past year.

“Last year, we were a $60 million market cap company with about $7 million in the bank. This year, we’re circa $215 million market cap, $22 million in the bank,” Ducler said. “It’s amazing what difference you can achieve in a year.”

From Scoping to Pre-Feasibility: A Step Change in Value

The current project configuration is based on a conventional large-scale open pit development model at Mandilla. The scoping study, released in late 2023, outlined:

-

100,000ozpa average gold production over the first 7.4 years

-

845,000oz total gold recovered over a 10.4-year mine life

-

All-in sustaining cost (AISC) of A$1,648/oz

-

Pre-tax NPV8 of A$442 million

-

IRR of 73%

-

Pre-tax free cashflow of A$740 million

-

Payback period of less than 9 months

These numbers were calculated using a gold price of A$2,750/oz, but Ducler flagged that the upcoming PFS will reflect a significantly higher price environment and improved mining parameters.

“For the pre-feasibility, the gold price is up well over 50 percent, the ounces are up well over 50 percent, and the operating costs are going to be pretty close to flat,” Ducler said. “So this pre-feasibility is going to generate an exceptional set of financials.”

Importantly, Astral has already locked in updated inputs from real-world RFQs across mining services, processing infrastructure, and logistics, using the mid-point of contractor pricing to avoid overly optimistic forecasts.

Consolidated Tenure Unlocks Mine Design Efficiency

In a move that resolved a key project constraint, Astral recently completed the acquisition of adjacent tenements from Maximus Resources, delivering a 144km² contiguous land package. This deal not only expanded the exploration footprint but removed mine design limitations at Mandilla’s key deposits—particularly Theia and Hestia.

Prior to the acquisition, pit shells were constrained by neighbouring boundaries, particularly for waste dump planning. “We saw the ability to save about $30 million worth of haulage costs just by building a better waste dump design,” Ducler explained. “The transaction cost was $30 million—so the ounces we get from Maximus, we get for free.”

The acquisition also opens up several underexplored gold targets at Spargoville, with first-pass drill programs due to begin by mid-2025.

Growing the Resource Base from Within

Astral has grown its group mineral resource base to 1.62 million ounces, with over 1.4Moz at Mandilla and 196koz at Feysville. These gains have been driven by cost-effective drilling and focused infill programs.

At Mandilla’s flagship Theia deposit, recent diamond drilling results include:

-

1m @ 223.3g/t Au

-

2.42m @ 169.1g/t Au

-

9.55m @ 27.6g/t Au

-

28m @ 2.63g/t Au

All four holes in the program returned gram-metre values above 100, with an average of 401 gram-metres—a record for the company.

This infill work also delivered a 49% uplift in indicated resources, enhancing conversion confidence as Astral moves toward production modelling.

“We’re now estimating these resources at an Aussie dollar gold price of $3,500 for the Whittle shell optimisations,” Ducler said. “And we’re using the actual mining and processing costs that will feed into the pre-feasibility study.”

Feysville and Spargoville Add High-Grade Upside

While Mandilla forms the project’s development base, Astral is looking to boost margins and extend mine life through high-grade satellite ore.

The Feysville Project, just 14km south of Kalgoorlie, has already delivered results from Kamperman such as:

-

6m @ 22g/t Au

-

21m @ 4g/t Au

-

10m @ 13g/t Au

Ducler said, “We are chasing high-grade gold that can displace some of the Mandilla low grade in the early part of the mine life. That’s how you maximise the NPV.”

An RC program is underway, testing additional anomalies across the Rogan Josh and Think Big prospects, and a maiden drilling campaign is planned at Spargoville.

Technical Inputs Completed for PFS

Key technical inputs for the PFS are now in place:

-

Geotech logging completed for Mandilla pits (Theia, Hestia, Iris, EOS)

-

Metallurgical recovery confirmed at 98.2% for Mandilla

-

Power study finalised, confirming cost-effective grid connection

-

Updated cost models reflecting RFQs from mining and processing contractors

Permitting requirements are not expected to trigger federal EPBC or WA EPA Part IV referrals, with approvals expected through DWER and DoW channels. First approvals could be secured within nine months of submission, allowing a development decision by mid-2026.

Fully Funded to Decision Point

Astral is well-funded through to final investment decision, with $22 million cash in hand (as of March 2025) and a further $6 million expected from in-the-money options due to expire later this year. Institutional shareholding has risen from 6% to 23% year-on-year, reflecting increasing investor confidence.

“At this conference last year, we were 6% institutionally owned. Today we’re 23%,” Ducler noted. “We’ve gone from a company that wanted to develop a project to one that now has the financial capacity to do so.”

Conclusion: Straightforward Path to Construction

With clear economics, a large-scale reserve base, and low-risk conventional mining and processing flowsheets, the project stands out among WA juniors.

“We have a series of conventional deposits. They are simple, bulk, open pit… tried and tested… low risk,” Ducler said. “We know it’s going to be bigger and better.”

With a PFS on the horizon and permitting paths mapped out, Astral Resources is now one step away from unlocking one of the Goldfields’ next mid-tier gold operations.